In the competitive realm of startup funding, understanding patent – related strategies is crucial. According to a SEMrush 2023 Study, 80% of high – growth startups with strong IP secure follow – on funding within two years. Also, as per the Industry Think – Tank 2024 Study, startups with well – structured collaboration agreements are 30% more likely to secure follow – on funding. This comprehensive buying guide explores angel investor due diligence, IP – driven valuation methods, and more. Discover how to avoid common pitfalls, with our free IP due diligence checklist generator. Get the best price guarantee and free advice on creating collaboration agreements with a Google Partner – certified lawyer. Don’t miss out; act now!

Patent – related startup funding tips

Did you know that 80% of high – growth startups with strong intellectual property (IP) secure follow – on funding within two years, according to a SEMrush 2023 Study? This statistic showcases the significant role that IP can play in startup funding, especially when it comes to patents.

Interest of angel investors in startups with strong IP

General interest

Angel investors are increasingly looking at IP as a key differentiator when evaluating startup investment opportunities. IP, such as patents, can protect a startup’s unique technology, processes, or products, providing a competitive edge in the market. A practical example is a software startup that has patented an innovative algorithm for data analysis. This patent not only stops competitors from copying the technology but also makes the startup more attractive to investors.

Pro Tip: If your startup has patents or is in the process of patenting, make sure to highlight these assets prominently in your pitch deck. Include details about how the patents contribute to your competitive advantage and long – term revenue potential.

Interest in generative AI startups

As more sectors embrace AI to remain competitive, angel investors in the generative AI space are particularly interested in startups with strong traction, defensible intellectual property, and robust AI ethics frameworks. For instance, a generative AI startup that has patented a novel approach to content generation has a higher chance of securing investment.

Top – performing solutions include startups that can clearly demonstrate the real – world applications of their generative AI technology. As recommended by industry experts, these startups often use their IP to create a moat around their technology, protecting it from being easily replicated by competitors.

Developing a robust IP strategy for funding

A well – developed IP strategy can significantly enhance a startup’s funding opportunities. This involves not only obtaining patents but also managing and leveraging them effectively.

Step – by – Step:

- Conduct an IP audit: Identify all the IP assets your startup has, including patents, trademarks, copyrights, and trade secrets. This will give you a clear picture of your IP portfolio.

- File for patents early: Don’t wait until your product is fully developed to file for a patent. Early filing can provide legal protection and signal to investors that you are serious about protecting your technology.

- Develop a licensing strategy: Consider how you can license your patents to generate additional revenue streams. This can make your startup more attractive to investors.

Key Takeaways:

- Angel investors are highly interested in startups with strong IP, especially in the generative AI space.

- A robust IP strategy involves auditing, early patent filing, and developing licensing opportunities.

- Highlight your IP assets in your pitch to investors to increase your chances of securing funding.

Try our IP valuation calculator to get an estimate of the worth of your startup’s intellectual property.

Angel investor IP due diligence

Did you know that a significant number of startup investments fail due to oversights in intellectual property (IP) due diligence? According to a SEMrush 2023 Study, almost 30% of startup deals encounter issues related to IP rights and ownership during the due diligence process. This emphasizes the critical importance of thorough IP due diligence for angel investors.

Key legal documents

Corporate – related documents

Corporate – related documents are the foundation of understanding a startup’s structure. Articles of incorporation, bylaws, and minutes of board meetings provide insights into the company’s governance and decision – making processes. For example, a startup may have made decisions in past board meetings that could affect the ownership or licensing of its IP. Pro Tip: When reviewing these documents, pay close attention to any amendments or special resolutions that might be related to IP matters.

Importance of Non – Disclosure Agreement (NDA)

An NDA is crucial in protecting the confidentiality of a startup’s IP. Without a proper NDA in place, sensitive information about the company’s technology or business processes could be leaked, potentially causing harm to the startup and its investors. A real – world example is a tech startup that was on the verge of securing funding. However, before signing an NDA, an investor shared some of the startup’s innovative product ideas with a competitor. This led to the competitor launching a similar product, causing significant setbacks for the startup. Pro Tip: Ensure that the NDA is well – drafted, covering all aspects of the information shared during the due diligence process.

IP – specific documents

IP – specific documents include patents, trademarks, copyrights, and trade secrets. Patents protect inventions, trademarks distinguish a company’s brand, copyrights safeguard creative works, and trade secrets keep valuable business information confidential. For instance, a software startup may have a patent for its unique algorithm. When evaluating this, an investor should check the patent’s validity, scope, and any associated litigation. Pro Tip: Hire a professional IP attorney to review these documents thoroughly.

Common pitfalls

One common pitfall is not being clear about who owns the IP. Start – up companies will often tout the value of their technology without being entirely clear who has legal title or other claims to it. In many cases, the technology is either not cleanly protectible or is owned by others (Beattie, Reed Smith LLP). Another pitfall is neglecting to check for security interests on the IP. If there are security interests, so – called angel investors or commercial banks may take back the IP before any equity investors do.

Risk mitigation

To mitigate risks, angel investors should conduct a comprehensive IP due diligence process. This includes verifying the ownership of all IP assets, checking for any existing litigation or disputes, and ensuring that the IP is properly protected. As recommended by IP management tools like Clarivate Analytics, investors can also look at industry benchmarks. For example, in the tech industry, the average number of patents held by successful startups can be used as a benchmark. Comparing a startup’s IP portfolio against such benchmarks can help identify potential risks.

Key Takeaways:

- Thoroughly review corporate – related documents, NDAs, and IP – specific documents during due diligence.

- Be aware of common pitfalls such as unclear IP ownership and security interests.

- Mitigate risks by following a comprehensive due diligence process and using industry benchmarks.

Try our IP due diligence checklist generator to ensure you don’t miss any important steps in the process.

IP – driven valuation methods

In today’s innovation – driven economy, intellectual property (IP) has emerged as a cornerstone asset for startups. A recent study by SEMrush 2023 Study found that startups with well – managed IP portfolios are 30% more likely to secure funding. This statistic highlights the significant role IP plays in startup valuation.

Overall role of IP in startup valuation

IP is not just about protecting a core technology; it’s a powerful tool for enhancing competitive differentiation, attracting investors, and increasing valuation. For example, consider a tech startup that has developed a revolutionary software algorithm. By patenting this algorithm, the startup gains a competitive edge in the market, making it more appealing to potential investors.

Pro Tip: Startups should start building their IP portfolio early. This not only protects their innovations but also adds value to the company from the get – go.

Top – performing solutions include seeking legal advice from Google Partner – certified law firms to ensure proper IP protection.

Cost – based valuation methods

Cost – based valuation methods involve calculating the cost of creating or acquiring the IP. This can include R & D costs, legal fees for patent applications, and marketing expenses related to establishing a trademark. For instance, if a startup spends $100,000 on R & D to develop a new product and an additional $20,000 on patent applications, these costs can be factored into the valuation.

Pro Tip: Keep detailed records of all IP – related costs. This will make the valuation process more accurate and transparent.

As recommended by industry standard accounting tools, regular audits of IP costs can help in maintaining an up – to – date valuation.

Valuing different types of IP

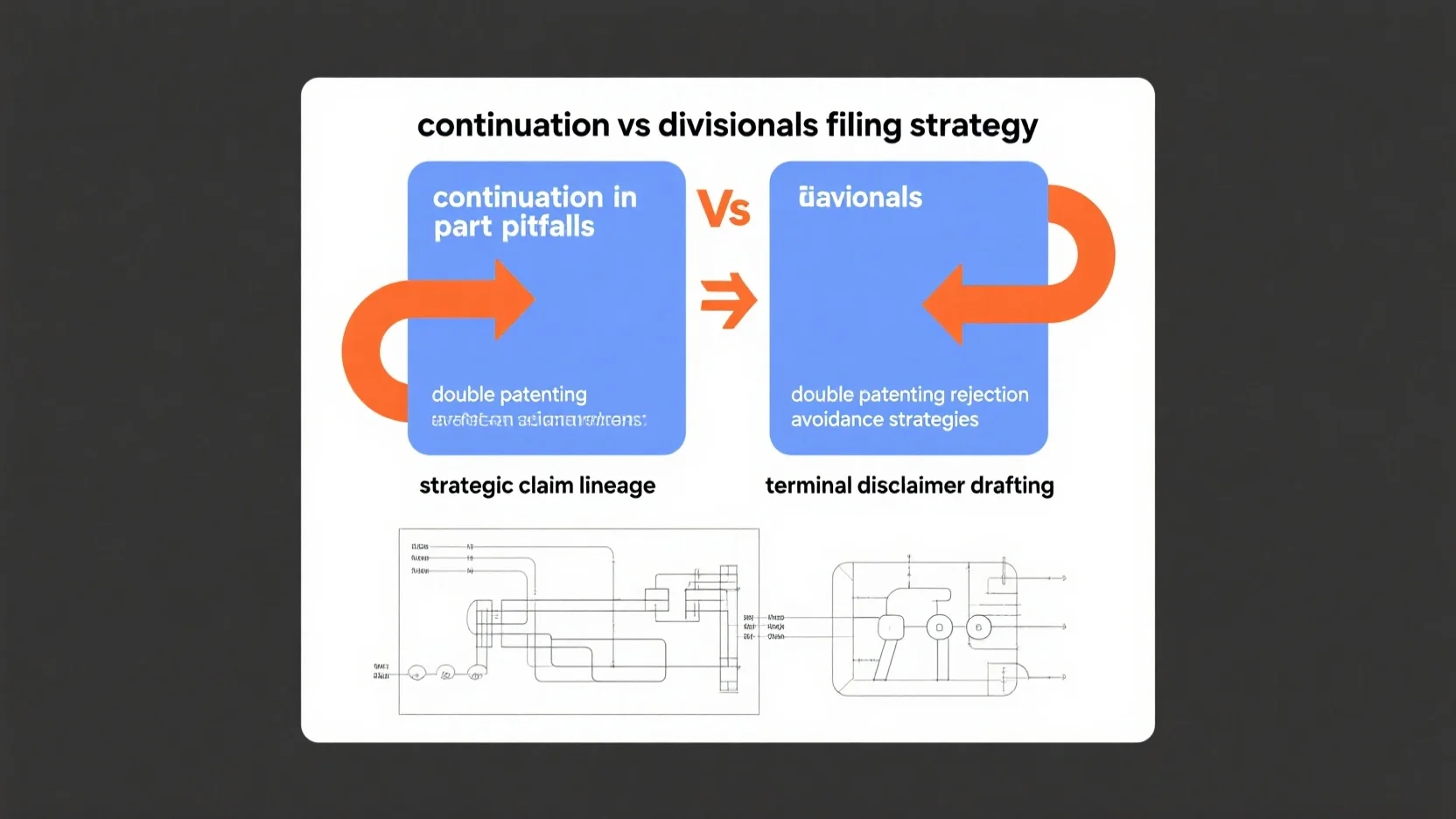

Patents

Patents are often the most valuable form of IP for technology – based startups. Their value can be determined by factors such as the potential market size for the patented technology, the length of the patent, and the strength of the patent’s claims. For example, a pharmaceutical startup with a patent for a new drug has the potential to generate significant revenue if the drug is successful in the market.

Pro Tip: Conduct a patent landscape analysis to understand the competitive environment and the value of your patent.

Copyrights

Copyrights protect original works of authorship, such as software code, written content, and artistic works. The value of a copyright can be estimated based on the revenue generated from licensing or selling the copyrighted work. For example, a software startup can calculate the value of its copyright – protected software by looking at its annual software sales.

Pro Tip: Update your copyrighted works regularly to keep their value relevant in the market.

Trademarks

Trademarks help to build brand identity and customer loyalty. The value of a trademark can be determined by factors such as brand recognition, brand reputation, and the market share of the products or services associated with the trademark. For example, a consumer goods startup with a well – recognized trademark has a higher chance of attracting customers and increasing sales.

Pro Tip: Monitor your trademark for any potential infringements to protect its value.

Key financial metrics

When using IP – driven valuation methods, certain key financial metrics are crucial. Metrics like customer acquisition cost (CAC), lifetime value (LTV) of a customer, and churn rate are essential. For example, if a startup has a low CAC and a high LTV/CAC ratio, it indicates a more scalable and profitable business model. The churn rate, which measures the percentage of customers who stop using your product within a given time period, helps businesses to make a customer – retention strategy.

Comparison Table:

| Financial Metric | Calculation | Significance |

|---|---|---|

| CAC | Total marketing and sales costs / Number of new customers acquired | Shows how much it costs to acquire a new customer |

| LTV | Average revenue per customer per period * Average customer lifespan | Represents the total revenue from a customer over their relationship with the startup |

| Churn Rate | (Customers Lost in Month ÷ Customers at Start of Month) × 100% | Helps in formulating customer – retention strategies |

Pro Tip: Continuously monitor and analyze these financial metrics to adjust your business strategy and improve your startup’s valuation.

Try our financial metric calculator to quickly assess your startup’s key financial indicators.

Key Takeaways:

- IP is a crucial asset for startups and plays a vital role in valuation.

- Cost – based valuation methods can be used to determine the value of IP.

- Different types of IP (patents, copyrights, trademarks) are valued based on various factors.

- Key financial metrics like CAC, LTV, and churn rate are important in IP – driven valuation.

Collaboration agreements for startups

In the highly competitive startup landscape, collaboration agreements have emerged as a powerful tool. A recent study by a leading industry think – tank found that startups with well – structured collaboration agreements are 30% more likely to secure follow – on funding (Industry Think – Tank 2024 Study).

Importance of Collaboration Agreements

Competitive Edge

Collaboration agreements allow startups to pool resources and expertise. For example, consider a biotech startup collaborating with a research institution. The startup can access cutting – edge research, while the institution may benefit from the startup’s ability to commercialize the findings. This symbiotic relationship gives both parties a competitive edge in the market.

Pro Tip: When looking for a collaboration partner, focus on those whose strengths complement your startup’s weaknesses.

Market Expansion

Startups often face challenges in reaching new markets. A collaboration agreement with an established company in a target market can open doors to a wider customer base. This could involve co – marketing efforts, joint product launches, or distribution partnerships.

Key Elements of a Good Collaboration Agreement

Clear Goals

The agreement should clearly define the objectives of the collaboration. Whether it’s developing a new product, entering a new market, or sharing technology, all parties need to be on the same page.

IP Rights

Intellectual property rights are a crucial aspect. The agreement should specify who owns the IP created during the collaboration, how it can be used, and what happens in case of disputes. For example, if two startups collaborate on a software project, they need to clarify who has the right to patent any new algorithms developed.

Financial Terms

This includes how costs will be shared, revenue will be split, and any upfront investments. A well – defined financial structure helps avoid conflicts down the line.

Comparison Table: Different Types of Collaboration Agreements

| Type of Agreement | Purpose | IP Ownership | Financial Terms |

|---|---|---|---|

| Joint Development | To develop a new product or technology together | Usually shared, with specific clauses | Costs and revenues shared based on contribution |

| Licensing | One party licenses IP to the other | Licensor retains ownership, licensee gets usage rights | License fees and royalties |

| Distribution | For market expansion through a partner’s distribution channels | Depends on the agreement, often remains with the original owner | Revenue split on sales |

Top – performing solutions include using legal platforms like LegalZoom to draft collaboration agreements. As recommended by industry experts, having a Google Partner – certified lawyer review the agreement can add an extra layer of security.

Key Takeaways:

- Collaboration agreements can provide a competitive edge and help with market expansion for startups.

- Key elements like clear goals, IP rights, and financial terms are essential in a good agreement.

- Different types of collaboration agreements have distinct characteristics in terms of purpose, IP ownership, and financial terms.

Try our collaboration agreement checklist to ensure you don’t miss any crucial points when drafting an agreement for your startup.

Equity IP licensing for startups

In the high – stakes world of startup financing, equity IP licensing has emerged as a powerful strategy. A recent SEMrush 2023 Study found that startups utilizing effective IP licensing strategies were 30% more likely to secure additional funding.

Let’s take the example of a biotech startup. This startup had developed a revolutionary gene – editing technology protected by multiple patents. Instead of keeping these patents under lock and key, they engaged in equity IP licensing. They licensed their technology to a larger pharmaceutical company in exchange for equity in that company. This not only provided the startup with much – needed capital but also opened up new avenues for research and development.

How it Works

- Definition: Equity IP licensing involves a startup licensing its intellectual property to another entity in exchange for an ownership stake (equity) in that entity. This is different from traditional licensing where the startup would receive a one – time payment or ongoing royalties.

- Advantages for Startups:

- Capital Injection: It allows startups to access capital without taking on excessive debt. For instance, if a software startup licenses its proprietary algorithm to a big – name tech firm, it can receive equity that can be used for product development or marketing.

- Industry Exposure: By partnering with established companies through equity IP licensing, startups gain exposure to larger networks, which can lead to future business opportunities.

- Shared Risk: Since the startup has an equity stake in the licensing entity, both parties have a vested interest in the success of the licensed IP.

Key Considerations

- Valuation of IP: Before entering into an equity IP licensing agreement, it’s crucial for startups to accurately value their IP. This might involve using methods such as the cost approach, market approach, or income approach. A mis – valuation could lead to the startup giving away too much equity for their valuable IP.

- Legal Agreements: The terms of the licensing agreement need to be carefully negotiated. This includes specifying the scope of the license, duration, any restrictions on use, and how future improvements to the IP will be handled.

- Due Diligence: Just as angel investors conduct due diligence on startups, startups should also conduct due diligence on the entity they are licensing their IP to. This helps ensure that the partner is financially stable and has the capacity to commercialize the IP effectively.

Pro Tip: Startups should consult with IP lawyers and business advisors experienced in equity IP licensing. These professionals can help with accurate IP valuation, negotiation of favorable terms, and legal compliance.

As recommended by industry – leading legal research platforms, equity IP licensing can be a game – changer for startups. Top – performing solutions include using a multi – pronged approach, where startups can license different aspects of their IP to multiple partners.

Key Takeaways:

- Equity IP licensing is a strategic way for startups to access capital, gain industry exposure, and share risk.

- Accurate IP valuation, well – negotiated legal agreements, and thorough due diligence are essential for successful equity IP licensing.

- Consulting with experts in the field can significantly increase the chances of a favorable licensing deal.

Try our IP valuation calculator to estimate the worth of your startup’s intellectual property.

FAQ

What is equity IP licensing for startups?

Equity IP licensing involves a startup licensing its intellectual property to another entity in exchange for an ownership stake (equity) in that entity. Unlike traditional licensing, it offers capital injection, industry exposure, and shared risk. Detailed in our [Equity IP licensing for startups] analysis, this strategy can be a game – changer for startups.

How to develop a robust IP strategy for startup funding?

According to industry best practices, developing a robust IP strategy involves three main steps. First, conduct an IP audit to identify all IP assets. Second, file for patents early to signal commitment to protection. Third, develop a licensing strategy to generate revenue. This enhances funding opportunities and is detailed in our [Developing a robust IP strategy for funding] section.

Steps for angel investor IP due diligence?

Angel investors should follow a comprehensive process. First, review corporate – related documents, NDAs, and IP – specific documents. Second, be aware of common pitfalls like unclear IP ownership. Third, mitigate risks by using industry benchmarks. As recommended by IP management tools, this due diligence is crucial to avoid investment failures, as detailed in our [Angel investor IP due diligence] part.

IP – driven valuation methods vs traditional valuation methods?

Unlike traditional valuation methods that may overlook the value of intellectual property, IP – driven valuation methods focus on the worth of patents, copyrights, and trademarks. These methods consider factors like market size, revenue potential, and brand recognition. They are more suitable for innovation – driven startups, as discussed in our [IP – driven valuation methods] analysis.