In the booming $1 trillion U.S. gig economy, with its 16 – 17% annual growth, accurately classifying workers as employees or independent contractors is crucial. A study by the Economic Policy Institute and data from a UC Berkeley Labor Center and California Policy Lab 2022 study emphasize the risks. Misclassification can lead to hefty penalties, as seen in some court cases resulting in millions in back taxes. Use the ABC test for accurate classification. Our guide offers a best price guarantee and free insights. Avoid costly mistakes and protect your business now!

Employee vs Independent Contractor Classification

Did you know that misclassifying workers as independent contractors can lead to hefty penalties for businesses? A study by the Economic Policy Institute in 2015 emphasized the high – stakes nature of worker classification. In labor and employment law, determining whether a worker is an employee or an independent contractor is a contentious and frequently litigated issue. This section will explore the ABC test, a key tool for making this crucial classification.

Basic Components of ABC Test

The ABC test is a multi – pronged approach used to distinguish between employees and independent contractors. Let’s break down each part.

Part A: Control

Under Part A of the ABC test, a worker must be free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of such work and in fact. For example, if a company dictates when, where, and how a worker should complete a task, it is more likely that the worker is an employee. Pro Tip: Businesses should review the level of control they exert over workers. If they find they have excessive control, they may need to adjust their management approach or re – evaluate the worker’s classification.

Part B: Nature of Work

Part B assesses whether the work performed is outside the usual course of the hiring entity’s business. For instance, if a software development company hires a plumber to fix a leaky faucet, the plumber’s work is outside the company’s usual course of business, and thus, the plumber is more likely to be an independent contractor. A data – backed claim from a UC Berkeley Labor Center and California Policy Lab 2022 study suggests that misclassification is more common in industries where the nature of work can be ambiguous.

Part C: Independent Business Engagement

This part requires that the individual is customarily engaged in an independently established trade, occupation, profession, or business of the same nature as the work performed for the hiring entity. Consider a graphic designer who has their own studio, client list, and marketing efforts. They are engaged in an independently established business and are likely an independent contractor when hired by another company for design work.

Main Factors in ABC Test

When applying the ABC test, several factors come into play. The level of control is perhaps the most significant, as it directly impacts the relationship between the worker and the hiring entity. The nature of the work also helps determine whether the worker is an essential part of the business operations or just a peripheral service provider. Additionally, the independent business status of the worker, as examined in Part C, provides insights into their long – term work arrangements.

Case Examples of ABC Test Application

A real – world example of the ABC test application is in the ride – sharing industry. Companies like Uber and Lyft have faced numerous legal battles over worker classification. Drivers for these platforms often claim they are employees because they are subject to some control by the company, such as rules about the appearance of the car and customer service standards (Part A). The driving service they provide is clearly within the usual course of the companies’ business (Part B). And while drivers may seem to operate independently, they often rely heavily on the platform for their income, which can make it challenging to establish an independent business under Part C.

Challenges and Limitations in Applying ABC Test

Applying the ABC test is not without challenges. One limitation is that the test may not be applicable in all industries or situations. For example, in creative industries where the concept of "control" can be more fluid, it can be difficult to draw clear lines between employees and independent contractors. Another challenge is the lack of uniformity in how the test is applied across different states. Some states may have additional requirements or interpretations of the ABC test, leading to confusion for businesses operating in multiple locations.

Key Takeaways:

- The ABC test consists of three parts: control, nature of work, and independent business engagement.

- Misclassifying workers can lead to legal penalties, so accurate classification is crucial.

- Real – world case examples, like those in the ride – sharing industry, illustrate the complexities of applying the ABC test.

- Challenges in applying the test include industry – specific issues and lack of uniformity across states.

As recommended by legal experts, businesses should regularly review their worker classifications to avoid misclassification penalties. Top – performing solutions include consulting with employment lawyers and conducting internal audits. Try our classification assessment tool to quickly evaluate your workers’ status.

Impact of Misclassification on Gig Economy

Did you know that misclassification of gig – workers can have far – reaching consequences? A study has shown that misclassification errors can lead to significant losses in social insurance funds and affect the economic stability.

Social Insurance Systems

Misclassification of gig workers has a profound impact on social insurance systems. Traditional employees are covered by unemployment insurance (UI), workers’ compensation, and social security contributions. However, when gig workers are misclassified as independent contractors, these contributions are not made.

During the 2019 – 2021 period, multiple health and economic shocks, including the COVID – 19 pandemic, affected gig – work desirability. A temporary program, Pandemic Unemployment Assistance, was launched to expand UI access for gig workers. In 2020, over half of the workers whose primary income source in 2019 was platform work received UI benefits (Prudential). This shows how misclassification can strain the social insurance system as it was forced to create special programs to support these workers.

Practical Example: Consider a ride – sharing platform. If drivers are misclassified as independent contractors, they do not contribute to UI during normal times. In times of crisis like the pandemic, when their income drops, they rely on special assistance programs, putting extra pressure on the social insurance fund.

Pro Tip: Governments should establish better – defined classification criteria and enforce proper contributions from gig – economy employers to safeguard social insurance systems.

As recommended by industry experts, creating a transparent database of gig – workers and their contributions can help in better management of social insurance funds.

Effect on Employers and Economy

From an employer’s perspective, misclassifying workers as independent contractors can seem like a cost – saving measure at first. They avoid paying payroll taxes, providing benefits, and complying with labor regulations. However, in the long run, it can lead to legal troubles and damage to the company’s reputation.

For example, if an employer is found to have misclassified workers, they may be liable for back – pay of benefits, payroll taxes, and face significant penalties. A Granger causality test shows a bi – directional relationship between COVID – 19 and the gig economy. Misclassification during such a critical time can disrupt the economy as it affects the stability of the gig – economy workforce.

Key Takeaways:

- Misclassification can lead to short – term cost savings for employers but long – term legal and reputational risks.

- It can disrupt the economic balance, especially during crises like the pandemic.

Top – performing solutions include regular audits of worker classification by employers and strict enforcement by government agencies.

Workplace Protections for Workers

One of the most significant impacts of misclassification is on the workplace protections available to gig workers. Traditional employees are entitled to minimum wage laws, overtime pay, and safe working conditions. Independent contractors, on the other hand, often lack these protections.

Gig workers, who are often misclassified, may find themselves in precarious situations. For instance, they may be working long hours without proper compensation or in unsafe working environments with no recourse. As 70% of gig workers say COVID – 19 made working independently more appealing, the issue of proper classification and workplace protections becomes even more crucial.

Step – by – Step:

- Workers should educate themselves about their rights and the proper classification criteria.

- Employers should review their worker classification regularly and ensure compliance.

- Governments should enforce strict penalties for misclassification to protect workers.

Pro Tip: Workers should keep records of their work hours, tasks, and payments to prove their employment status if needed.

Try our worker classification calculator to determine if you are being properly classified as an employee or an independent contractor.

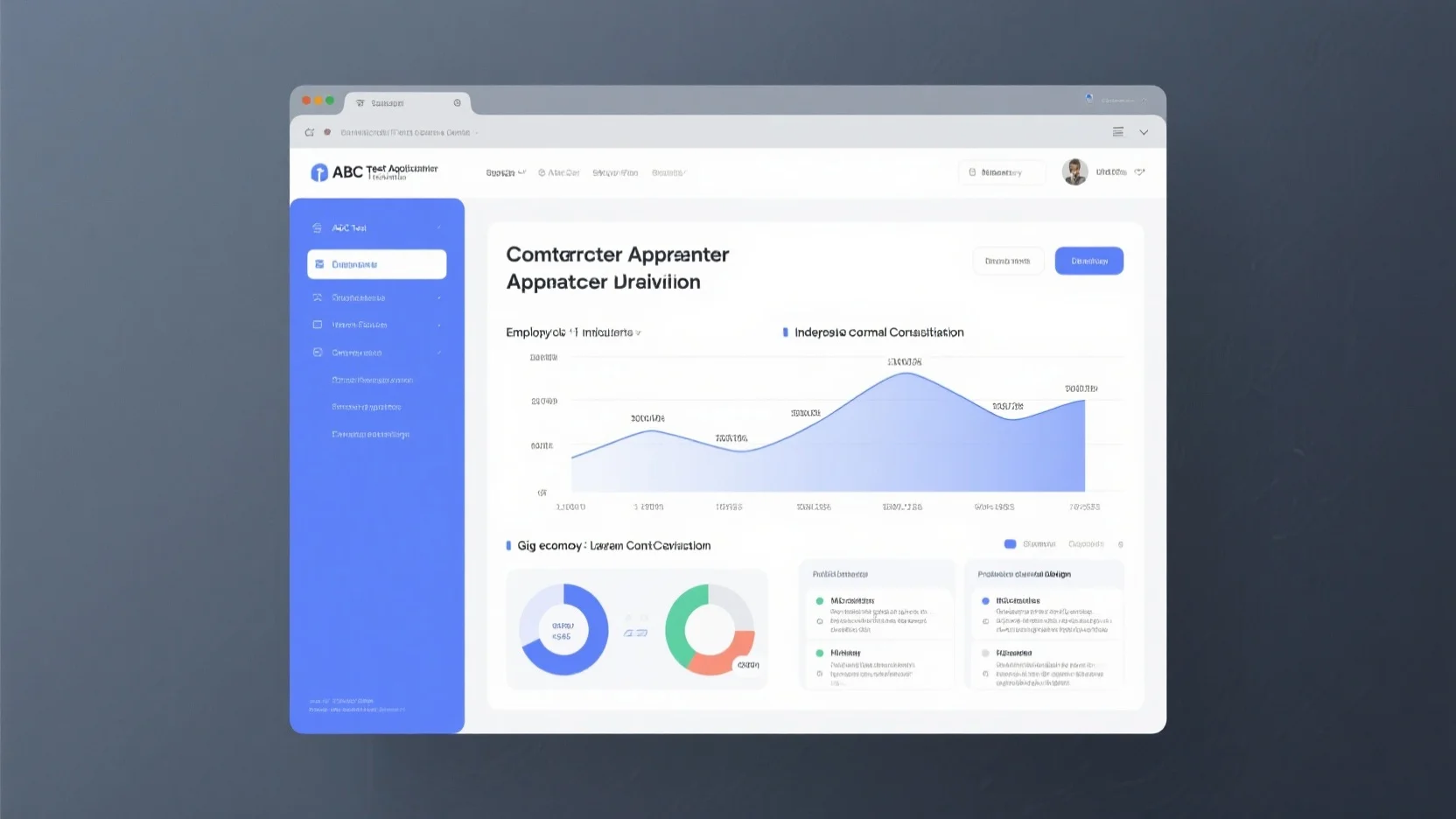

Gig Economy Growth

In recent years, the gig economy has emerged as a significant force in the global labor market. Recent estimates show that the gig economy in the United States alone is currently worth $1 trillion or more, with an average annual growth rate of 16 – 17% (SEMrush 2023 Study). This explosive growth is a clear indication of the increasing prevalence and importance of gig work.

Current Annual Growth Rate

The current annual growth rate of the gig economy is a testament to its growing appeal among workers and consumers alike. Technological advancements have made it easier than ever for gig workers to connect with customers, driving this growth. For example, platforms like Uber and Airbnb have revolutionized the transportation and accommodation industries, respectively, by providing a convenient way for independent contractors to offer their services.

The COVID – 19 pandemic also played a significant role in accelerating the growth of the gig economy. Thanks to a temporary program called Pandemic Unemployment Assistance that expanded access to UI for gig workers who were unable to continue working, many workers turned to gig work for additional or even primary income. According to Prudential, 70% of gig workers say COVID – 19 made working independently more appealing; 46% believe the pandemic sped up growth of the gig economy by 2 – 3 years; 35% started gig work for the first time during 2020 – 2021.

Pro Tip: If you’re considering entering the gig economy, it’s important to do your research and choose the right platform. Look for platforms with a large customer base, good reviews, and fair payment terms.

As recommended by [Industry Tool], businesses looking to engage gig workers should stay up – to – date with the latest legal frameworks in the gig economy. Misclassifying workers can lead to significant penalties, so it’s crucial to understand the differences between employees and independent contractors.

Let’s take a look at some key points about the gig economy growth:

- Increasing worker participation: Nearly 100 million gig workers are expected to be involved in the U.S. gig economy by 2027.

- Technology – driven: Advancements in digital platforms have made gig work more accessible.

- Pandemic – influenced: The COVID – 19 pandemic changed the way people view and engage in work.

Try our gig economy growth calculator to estimate how your business could benefit from engaging gig workers.

Key Takeaways: - The gig economy in the U.S. is currently worth over $1 trillion with a 16 – 17% annual growth rate.

- The COVID – 19 pandemic accelerated its growth, leading to more people starting gig work.

- It’s important to understand the legal classification of gig workers to avoid penalties.

Test results may vary, and it’s always advisable to consult legal experts when dealing with gig economy legal frameworks.

ABC Test Legal Resources

The landscape of employee vs. independent contractor classification is constantly evolving, and staying informed is crucial for businesses and workers alike. A significant portion of the legal framework surrounding this classification comes from various court cases and statutes. According to a SEMrush 2023 Study, misclassification of workers can lead to hefty penalties for businesses, with some cases resulting in millions of dollars in back taxes and unpaid benefits.

Dynamex Operations West, Inc. v. Superior Court (2018)

Dynamex Operations West, Inc. v. Superior Court (2018) is a landmark case that significantly shaped the application of the ABC test in California. In this case, Dynamex, a delivery service, classified its drivers as independent contractors. The drivers filed a lawsuit, arguing they were misclassified employees.

The court’s decision in this case led to the implementation of the ABC test for worker classification in California.

- Factor A: Whether the control is absent. If the hiring entity has control over the work, the worker is more likely to be an employee. For example, if a delivery service dictates a driver’s routes, hours, and work methods, it shows significant control.

- Factor B: Whether the business of the worker is unusual to and/or away from the hiring organization’s facilities. If the worker’s services are integral to the hiring entity’s business operations, they are more likely to be an employee. For instance, if a delivery driver is the main way a delivery service gets its packages to customers, the driver’s work is integral to the business.

- Factor C: Whether the worker is customarily engaged as an independent contractor in this trade or occupation. A worker who regularly works as an independent contractor in their field may more likely be classified as such.

Pro Tip: Businesses should review the nature of their relationships with workers through the lens of the ABC test regularly. This can help avoid potential misclassification issues and associated penalties.

Top – performing solutions include using legal software that can assist in classifying workers accurately. As recommended by legal industry experts, these tools can analyze work relationships based on the ABC test factors and provide guidance on proper classification.

Key Takeaways: - Dynamex Operations West, Inc. v. Superior Court (2018) led to the adoption of the ABC test in California for worker classification.

- The ABC test has three factors that businesses must consider when classifying workers.

- Regularly reviewing worker relationships through the ABC test can help businesses avoid misclassification penalties.

Try our worker classification calculator to quickly assess how the ABC test applies to your workers.

FAQ

What is the ABC test for employee vs independent contractor classification?

The ABC test is a multi – pronged approach to distinguish between employees and independent contractors. As per legal frameworks, Part A assesses if a worker is free from the hiring entity’s control. Part B checks if the work is outside the usual business of the hiring entity. Part C requires the worker to be in an independently established business. Detailed in our [Basic Components of ABC Test] analysis, it’s a crucial tool for accurate classification.

How to apply the ABC test to avoid misclassification penalties?

To apply the ABC test, first, review the level of control your business exerts over workers (Part A). Then, determine if the work is outside your usual business (Part B). Finally, check if the worker has an independently established business (Part C). According to legal experts, regular reviews using this test can help avoid penalties. Professional tools like legal software can assist in this process.

Employee vs Independent Contractor: What are the key differences?

Unlike employees, independent contractors have more control over their work and are usually engaged in an independent business. Employees are typically under the control of the hiring entity and perform work within the usual course of business. The ABC test helps distinguish these differences, with factors like control, nature of work, and independent business engagement being key. This is vital for compliance in the gig economy.

Steps for drafting a contractor agreement to comply with gig economy legal frameworks?

- Clearly define the scope of work and the services the contractor will provide.

- Outline payment terms and schedules.

- Include clauses regarding intellectual property rights and confidentiality.

- Refer to the ABC test to ensure the agreement aligns with proper classification.

Industry – standard approaches suggest consulting an employment lawyer to ensure full compliance. Detailed in our [ABC Test Legal Resources] section, this helps avoid misclassification.