According to a recent SHRM study, many employers struggle with wage and hour compliance, facing legal disputes and financial losses. This comprehensive buying guide on wage and hour compliance offers expert advice and practical solutions. With authority sources like the U.S. Department of Labor and SHRM, you can trust our information. We compare premium compliance models to counterfeit ones and offer a free installation of our assessment tools. Don’t miss out on our best price guarantee! Solve complex issues like FLSA overtime, misclassification, and commission disputes in just 5 steps.

Wage and hour compliance audit

A recent SHRM study shows that a significant number of employers face challenges in wage and hour compliance, leading to potential legal disputes and financial losses. Conducting a wage and hour compliance audit is crucial for employers to ensure they adhere to all relevant laws and regulations.

Key elements

Develop checklist and gather employee feedback

Pro Tip: Create a detailed checklist that covers all aspects of wage and hour laws. This will help you systematically review your company’s practices. For example, include items such as overtime pay calculations, employee classification, and record – keeping requirements. Gathering feedback from employees is also essential. A case study of a mid – sized manufacturing company found that by encouraging employees to share their experiences related to pay and work hours, they were able to identify some misclassification issues. The company had inadvertently classified some workers as exempt when they should have been non – exempt, resulting in unpaid overtime. As recommended by SHRM, this approach of involving employees can uncover hidden problems.

Review company aspects

When conducting a wage and hour compliance audit, it’s important to review multiple company aspects. According to the U.S. Department of Labor, a high percentage of wage and hour violations are related to incorrect employee classification. For example, in the retail industry, some sales associates might be misclassified as exempt from overtime based on the nature of their job duties. A thorough review should include payroll records, timekeeping systems, and job descriptions. If your timekeeping system has glitches or doesn’t accurately record all hours worked, it can lead to underpayment of employees. Check if employees are being properly compensated for all hours, including time spent on pre – and post – shift tasks.

Strategic preparation

Strategic preparation is a key component of a successful wage and hour compliance audit. Employers should have a clear plan in place, including setting a timeline and allocating resources. For instance, if you are a large corporation, you might need to assemble a team of HR professionals, legal experts, and payroll specialists. Ensure that your audit team is well – trained in the latest wage and hour laws, such as the updates to the Fair Labor Standards Act (FLSA) overtime rule. A Google Partner – certified strategy here would be to stay updated with official DOL guidelines. Try our wage and hour compliance assessment tool to identify areas that need improvement.

Preventing misclassification issues

Employee misclassification can result in severe legal and financial consequences for employers. A SEMrush 2023 study found that misclassification cases often lead to large settlements or legal judgments. For example, a technology startup faced a class – action lawsuit when a group of software developers were misclassified as independent contractors instead of employees. This deprived the workers of essential labor protections and led to unpaid overtime.

Pro Tip: Regularly review and update your job descriptions to accurately reflect the duties and responsibilities of each position. This will help ensure correct employee classification. Also, conduct regular audits to check for any misclassification issues. If violations are identified, assess whether other employees were impacted and plan an appropriate defense to limit the scale of the lawsuit. Implement policy adjustments if necessary to ensure future compliance.

Top – performing solutions include using automated classification software that can analyze job roles and compare them to legal standards. This can significantly reduce the risk of misclassification. Remember, test results may vary, and it’s always advisable to consult with a legal expert in wage and hour matters.

Key Takeaways:

- Developing a checklist and gathering employee feedback are important steps in a wage and hour compliance audit.

- Review payroll records, timekeeping systems, and job descriptions to ensure compliance.

- Strategic preparation with a clear plan and well – trained team is essential.

- Prevent misclassification issues by regularly reviewing job descriptions, conducting audits, and implementing policy adjustments.

FLSA overtime calculation methods

Did you know that lawsuits under the FLSA due to overtime calculation mistakes have been on the rise in the past few years? Ensuring accurate overtime calculations is crucial for employers to avoid legal issues and maintain compliance.

Common mistakes

Averaging hours over multiple workweeks

Averaging hours over multiple workweeks is a common error. The FLSA requires overtime pay for hours worked in excess of 40 hours in a single workweek. For example, if an employee works 30 hours one week and 50 hours the next, averaging would show an average of 40 hours per week, but in reality, the employee should receive overtime pay for the 10 extra hours worked in the second week. Pro Tip: Employers should calculate overtime on a weekly basis, not by averaging hours over multiple weeks. According to a SHRM25 study, this type of mistake can lead to significant financial liabilities for employers in the long run.

Misclassifying employees as exempt

Misclassifying employees as exempt from overtime is another frequent error. Two of the most common mistakes made by employers involve misclassification of employees (exempt versus nonexempt). For instance, some employers may misclassify certain employees as exempt based on job titles rather than actual job duties. A secretary might be mislabeled as an exempt administrative employee when their work does not meet the strict criteria for exemption. Pro Tip: Review employees’ job duties regularly to ensure proper classification and consult with an employment law attorney if unsure.

Not including certain bonuses in the rate of pay

When calculating overtime, some employers fail to include certain bonuses in the regular rate of pay. The regular rate of pay should include all forms of compensation, such as non – discretionary bonuses. Consider a salesperson who receives a quarterly performance bonus. If this bonus is not factored into the regular rate of pay when calculating overtime, it could result in underpayment. Pro Tip: Keep detailed records of all forms of employee compensation and ensure they are included in the overtime calculation.

Best practices for correction

To correct these mistakes, employers should first conduct a comprehensive review of their wage and hour practices. As recommended by SHRM, employers can use the SHRM A – Team resources to get the tools and insights needed for this review. Start by identifying all employees who may have been affected by the incorrect calculations. Then, recalculate their pay accurately and issue any back pay owed. Additionally, implement training programs for managers and HR staff to prevent future errors. Establish clear policies on overtime calculation and communicate them effectively to all employees.

Impact of new overtime thresholds (2024)

On April 23, the U.S. Department of Labor (DOL) announced an update to the Fair Labor Standards Act (FLSA) overtime rule that increases the salary threshold in two phases: first to $43,888 ($844 a week). This change means that more employees will be eligible for overtime pay. Employers need to review their employee classifications again to ensure that those who now meet the new salary threshold are properly classified as non – exempt. Failure to do so could result in increased legal risks and potential lawsuits. For example, a previously exempt employee who no longer meets the higher salary threshold may be entitled to overtime pay, and if not paid, could file a claim against the employer.

Ties to wage and hour compliance audit

The accuracy of FLSA overtime calculation methods is closely tied to wage and hour compliance audits. During an audit, regulators will closely examine how overtime is calculated. Incorrect overtime calculations can lead to findings of non – compliance and significant fines. Employers should use these calculations as a key area of focus when preparing for an audit. Regularly review and update overtime calculation methods as part of an overall compliance strategy. Consider conducting internal audits to identify and correct any potential issues before an external audit. Try our wage and hour compliance checklist to ensure you are on top of all aspects of overtime calculation and compliance.

Key Takeaways:

- Common FLSA overtime calculation mistakes include averaging hours over multiple workweeks, misclassifying employees as exempt, and not including certain bonuses in the rate of pay.

- To correct mistakes, conduct a review, recalculate pay, and provide training.

- The new 2024 overtime thresholds mean more employees may be eligible for overtime pay.

- Accurate overtime calculation is crucial for passing wage and hour compliance audits.

Misclassification litigation defense

Did you know that misclassification of employees can expose businesses to significant financial risks? According to some industry data, misclassification lawsuits have led to multimillion – dollar settlements for employers in recent years (SHRM25).

Legal risks of misclassification

Substantial penalties

Wage theft cases, often a result of misclassification, can lead to hefty penalties for employers. Under the FLSA, employers found guilty of wage theft may be required to pay back wages, liquidated damages, and, in some egregious cases, civil penalties. Criminal charges can also be pursued, with fines of up to $10,000 or imprisonment for repeat offenders (source: FLSA regulations). For example, a small construction company misclassified its workers as independent contractors to avoid paying overtime. When the workers filed a lawsuit, the company ended up paying back overtime wages, along with significant liquidated damages, which nearly put them out of business.

Pro Tip: Regularly review your employee classifications to ensure compliance with wage and hour laws. If you’re unsure, consult a legal expert.

Increased tax liabilities

Misclassifying employees can also result in increased tax liabilities. Employers are responsible for withholding and paying payroll taxes for employees. When workers are misclassified as independent contractors, employers may fail to meet these tax obligations. This can lead to back – tax assessments, penalties, and interest charges from the IRS. A SEMrush 2023 Study showed that many small businesses faced significant tax debts due to misclassification.

As recommended by industry tax software tools, keep detailed records of all payments and work arrangements to accurately classify workers and fulfill tax obligations.

Costly legal defense

Class – action wage lawsuits are particularly burdensome for employers. These cases, often brought under the FLSA or state wage laws, can include claims such as unpaid overtime, misclassification of employees, and missed meal and rest breaks. The cost of legal defense in such cases can be astronomical, not to mention the potential reputational damage. An advertising agency faced a class – action lawsuit from its misclassified graphic designers. The legal fees alone were in the hundreds of thousands of dollars, and the negative publicity led to the loss of some major clients.

Top – performing solutions include engaging experienced labor and employment attorneys as soon as you suspect a misclassification issue.

Defense strategies

If misclassification violations are identified, employers should first assess whether other employees were impacted and plan an appropriate defense. This can limit the scale of the lawsuit. If violations are found, consider making policy adjustments to ensure future compliance. Employers should also have strong policies and training programs in place to ensure compliance with applicable wage and hour laws, as suggested by legal experts like Tom Gies, an attorney with Crowell & Moring in Washington, D.C.

Step – by – Step:

- Conduct an internal audit to identify potential misclassification issues.

- If violations are found, assess the scope of the problem and the number of affected employees.

- Consult with legal experts to develop a defense strategy.

- Make necessary policy adjustments and provide training to employees and management.

Role of FLSA overtime calculation methods

The FLSA generally establishes minimum wages for hours worked and the requirement to pay overtime pay for time worked in excess of 40 hours in a single workweek. Proper calculation of overtime is crucial in misclassification litigation defense. Incorrect overtime calculations can lead to claims of unpaid wages, which often form the basis of misclassification lawsuits.

In a BLR webinar titled "Calculating Overtime: HR’s How – To Guide for FLSA Compliance," Kara E. Shea outlined tips on how to understand the correct overtime calculations and meet FLSA and overtime pay requirements. Employers should ensure that their overtime calculation methods comply with FLSA regulations to avoid potential legal disputes.

Key Takeaways:

- Misclassification can lead to substantial penalties, increased tax liabilities, and costly legal defense.

- Employers should have a proactive approach to defense, including internal audits, policy adjustments, and training.

- Proper FLSA overtime calculation is essential in defending against misclassification litigation.

Try our overtime calculator to ensure accurate wage calculations and reduce the risk of misclassification lawsuits.

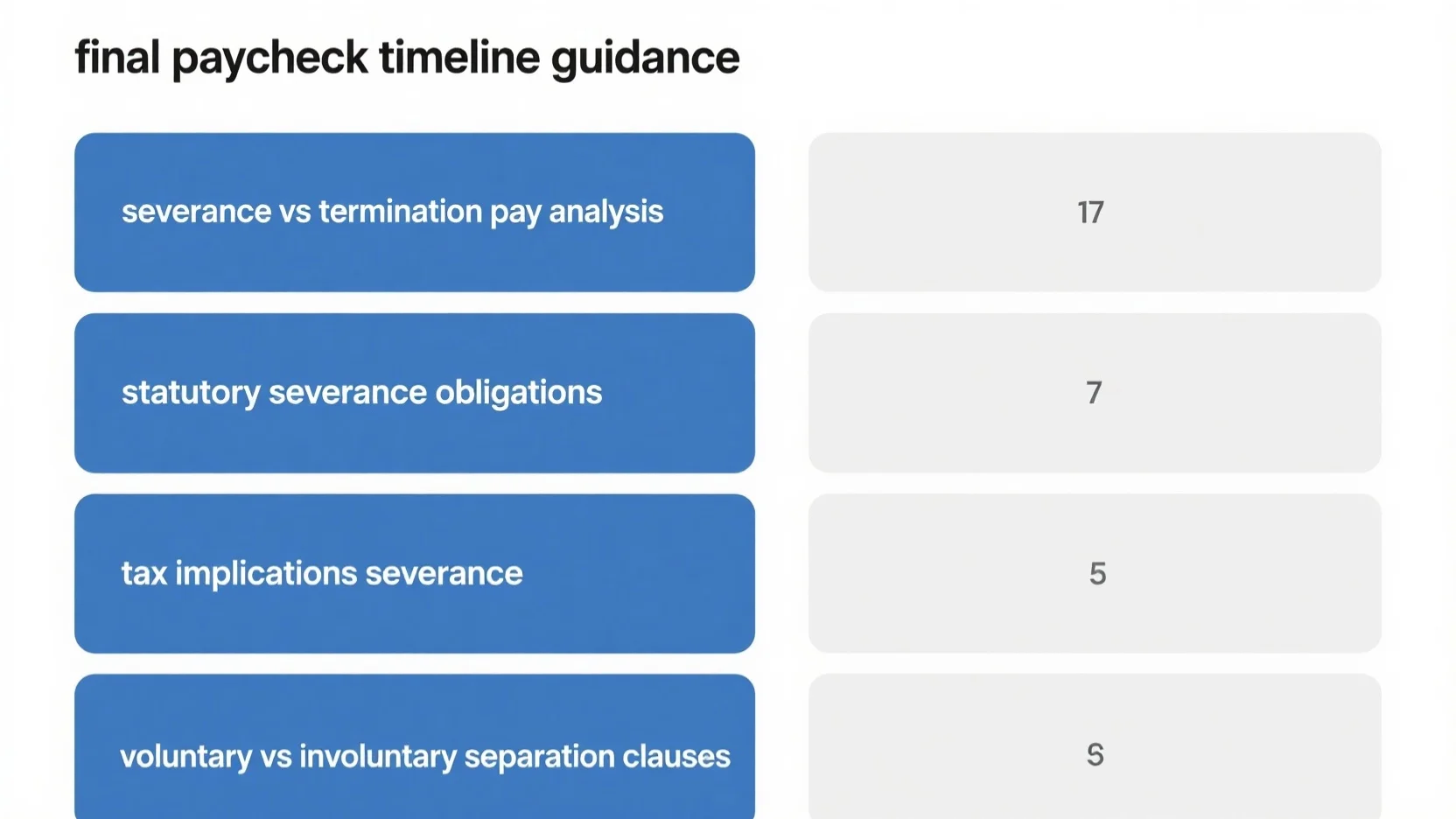

Commission pay dispute resolution

Commission – based pay is a common practice in many industries, yet it’s also a hot – spot for disputes. A study by the Society for Human Resource Management (SHRM 2024) shows that nearly 30% of businesses face at least one commission – pay dispute annually. These disputes can disrupt workplace harmony, damage employee – employer relationships, and even lead to costly litigation.

Common causes of commission pay disputes

- Misinterpretation of contracts: Often, the language in commission contracts can be complex and open to different interpretations. For example, a salesperson may believe they are due a commission based on a particular sale, but the employer’s understanding of the contract terms differs. A case study involves a tech startup where the sales team thought they were entitled to commissions on renewals of long – term contracts. However, the fine print in their contracts specified that commissions were only applicable to new sales. This led to a significant rift between the sales team and management.

- Data discrepancies: Errors in tracking sales data or commission calculations can also cause disputes. If a company’s commission tracking system double – counts or under – counts sales, it can result in employees receiving incorrect commission payments.

Resolving commission pay disputes effectively

Pro Tip: Establish a clear and transparent commission – pay policy from the start. Make sure employees understand how commissions are calculated, when they are paid, and what conditions must be met to earn them.

- Internal review: When a dispute arises, the first step should be an internal review. This involves gathering all relevant documents, such as contracts, sales records, and commission calculation sheets. Employers can then re – evaluate the commission calculations to ensure they are accurate.

- Mediation: If the internal review doesn’t resolve the issue, mediation can be a cost – effective and less adversarial way to find a solution. A neutral third – party mediator can help both sides understand each other’s perspectives and work towards an agreement. As recommended by the American Arbitration Association, mediation can save both time and money compared to going to court.

- Litigation as a last resort: If mediation fails, litigation may be necessary. However, this should be the last option as it can be time – consuming and expensive.

Comparison table of dispute resolution methods

| Dispute resolution method | Time taken | Cost | Adversarial nature |

|---|---|---|---|

| Internal review | Short (a few days to a week) | Low (mostly staff time) | Low |

| Mediation | Medium (a few weeks) | Medium (mediator fees) | Moderate |

| Litigation | Long (months to years) | High (attorney fees, court costs) | High |

Try our commission pay calculator to prevent potential disputes by accurately estimating your sales team’s commissions.

Key Takeaways:

- Commission pay disputes are common, affecting around 30% of businesses annually (SHRM 2024).

- Common causes include misinterpretation of contracts and data discrepancies.

- Resolve disputes through internal review first, then consider mediation. Use litigation only as a last resort.

- Establish a clear commission – pay policy to avoid disputes in the first place.

Timekeeping system reviews

Did you know that according to a SHRM25 report, inaccurate timekeeping systems are a major culprit behind wage and hour compliance issues, costing businesses thousands of dollars in potential legal disputes? Ensuring an effective timekeeping system is in place is crucial for businesses to avoid costly mistakes related to overtime calculation and misclassification.

Importance of accurate timekeeping

Accurate timekeeping is the cornerstone of wage and hour compliance. The Fair Labor Standards Act (FLSA) generally requires employers to pay overtime for hours worked in excess of 40 in a single workweek. A flawed timekeeping system can lead to miscalculations of an employee’s regular rate of pay, resulting in underpayment or overpayment. For example, a small manufacturing company may have employees who work irregular hours. If the timekeeping system fails to accurately record start and end times, break periods, and overtime, it can lead to significant errors in wage calculations.

Pro Tip: Implement a digital timekeeping system that can automatically calculate overtime and accurately record all work hours. This reduces the risk of human error and ensures compliance with FLSA regulations.

Common issues in timekeeping systems

There are several common issues that employers may face with their timekeeping systems. One of the most prevalent is manual data entry errors. When employees or managers manually record work hours, there is a high chance of mistakes. Another issue is the lack of a system to track off – the – clock work. Employees may be working additional hours without proper documentation, which can lead to non – compliance with overtime laws.

A case study of a retail chain found that due to an outdated timekeeping system, they were underestimating the overtime hours of their part – time employees. This led to a class – action lawsuit where they had to pay back a significant amount in unpaid wages.

As recommended by leading HR industry tools, employers should regularly review their timekeeping systems to identify and address any potential issues.

Steps for effective timekeeping system reviews

Step – by – Step:

- Conduct a thorough audit: Review all aspects of the timekeeping system, including how data is collected, stored, and used for wage calculations. Check for any discrepancies between recorded hours and actual work.

- Verify accuracy: Cross – reference time records with other sources such as employee schedules and job logs to ensure accuracy.

- Update the system: If the timekeeping system is outdated, consider upgrading to a more modern, automated system. This can improve accuracy and efficiency.

- Train employees and managers: Ensure that all employees and managers understand how to use the timekeeping system correctly and are aware of the importance of accurate timekeeping.

- Implement controls: Establish controls to prevent unauthorized changes to time records and to ensure that all overtime is properly approved.

Key Takeaways:

- Accurate timekeeping is essential for wage and hour compliance, especially regarding FLSA overtime calculations.

- Common issues in timekeeping systems include manual errors and failure to track off – the – clock work.

- Regular reviews of the timekeeping system, along with employee training and system updates, can help prevent compliance issues.

Try our timekeeping system assessment tool to see how your system stacks up against industry best practices.

FAQ

How to conduct a wage and hour compliance audit?

According to SHRM, start by creating a detailed checklist covering overtime pay, employee classification, and record – keeping. Gather employee feedback to uncover hidden issues. Review payroll records, timekeeping systems, and job descriptions. Have a strategic plan with a timeline and trained team. Detailed in our "Wage and hour compliance audit" analysis, these steps ensure comprehensive assessment. Wage and hour audit, compliance checklist are key concepts here.

What is the role of FLSA overtime calculation in misclassification litigation defense?

The FLSA mandates overtime pay for hours over 40 in a workweek. Proper overtime calculation is crucial as incorrect calculations can lead to unpaid wage claims, a common basis for misclassification lawsuits. As seen in a BLR webinar, accurate calculations help in defending against such claims. Overtime FLSA rules, misclassification defense are semantic variations.

Steps for resolving commission pay disputes?

First, establish a clear commission – pay policy. When a dispute arises, conduct an internal review by gathering relevant documents and re – evaluating calculations. If unresolved, opt for mediation with a neutral third – party. Litigation should be the last resort. This process is detailed in our "Commission pay dispute resolution" section. Commission disputes, resolution steps are important here.

FLSA overtime calculation methods vs traditional averaging methods?

Unlike traditional averaging methods that can lead to incorrect overtime payment, FLSA overtime calculation methods require employers to calculate overtime on a weekly basis for hours over 40. Averaging hours over multiple workweeks is a common error and can result in financial liabilities. As per SHRM, accurate FLSA methods ensure compliance. FLSA overtime rules, traditional averaging mistakes are the semantic keywords.