Are you drowning in tax debt? Our comprehensive buying guide reveals premium strategies for Offer […]

Category: Tax Fraud Lawyer

Comprehensive Guide to Tax Fraud Training, Employee Awareness, Phishing Drills, Case Studies, and Continuing Education Credits

In 2024, tax fraud led to significant losses, with the IRS – CI initiating 545 […]

Comprehensive Guide to IRS Criminal Tax Investigation Defense: Grand Jury, Voluntary Disclosure, Whistleblower Protection & Penalty Mitigation

Facing an IRS criminal tax investigation? Don’t panic! Our comprehensive buying guide reveals top – […]

Comprehensive Guide: Criminal Tax Appeal, New Evidence Criteria, Post – Conviction Relief, Counsel Claims & Habeas Corpus Tax Cases

Facing a criminal tax appeal can be overwhelming, but this comprehensive buying guide offers essential […]

Comprehensive Guide to Whistleblower Retaliation Lawsuits: SOX, Dodd – Frank Protections, Anonymous Disclosure & Remedy Options

In today’s business world, whistleblower retaliation lawsuits are soaring, with a 20% increase in claims […]

Comprehensive Guide to Tax Fraud Media Relations: Reputation Management, Legal Insights & Stakeholder Communication

Navigating tax fraud media relations is crucial for businesses facing investigations. According to a SEMrush […]

Comprehensive Guide to Fee Arrangements in High-Stakes Tax Defense: Contingency, Hourly, and Retainer Best Practices

In high-stakes tax defense cases, choosing the right fee arrangement is crucial. According to a […]

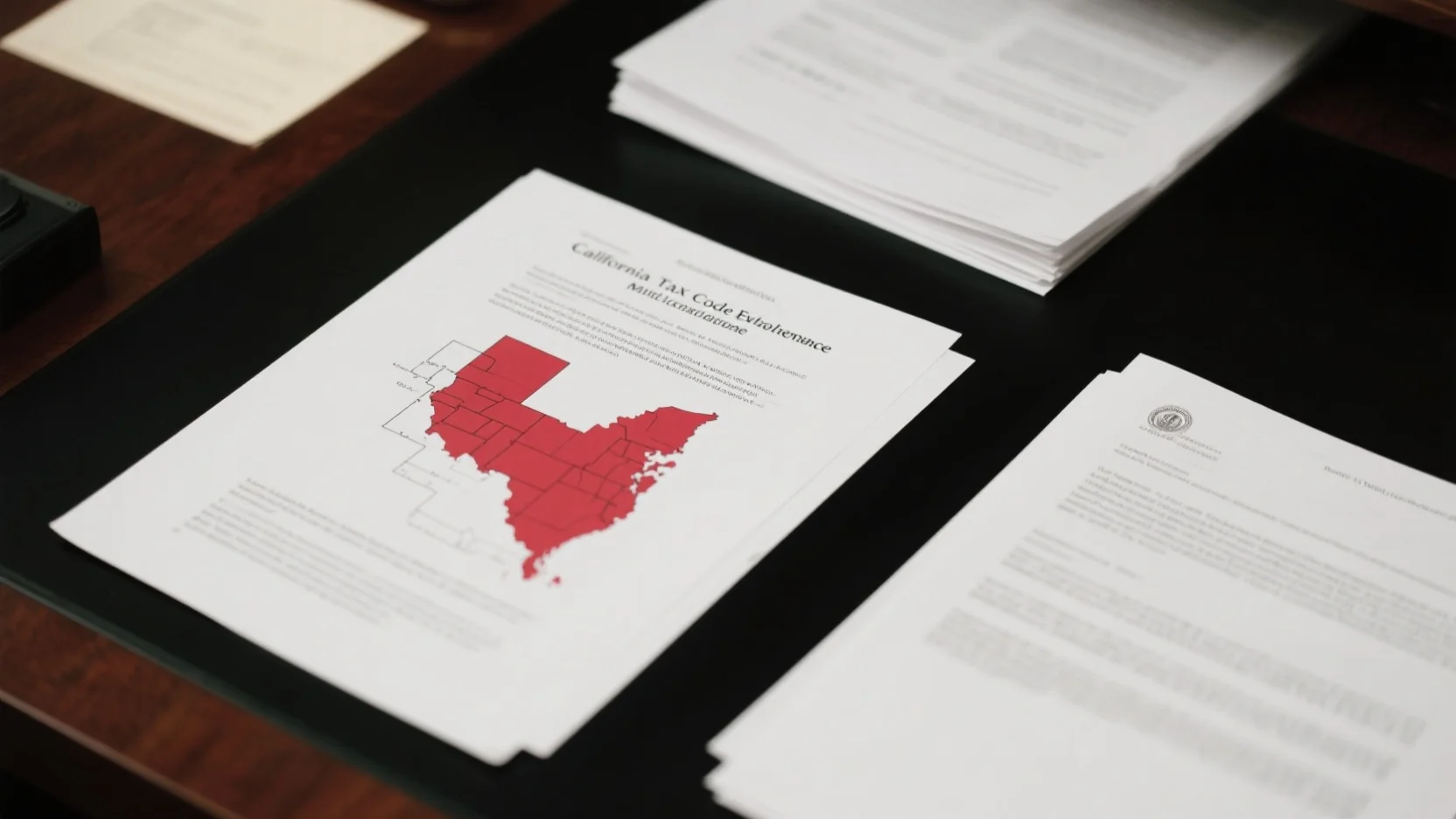

Unraveling State vs Federal Tax Fraud: California Defense, NY Issues, Multistate Litigation & Reciprocity Navigation

Are you confused about state vs federal tax fraud? In 2023, a SEMrush study found […]

Comprehensive Guide: Tax Whistleblower Reward Program Tips, Appeals, Protections, Eligibility, and Application Best Practices

Looking to cash in on a tax fraud tip? Our Buying Guide reveals the best […]